Retail Proposition Index 2024

Delivering More Than You Bargained ForIntroduction

In this 14th edition of OC&C’s annual Retail Proposition Index (RPI), we have asked over 48,000 shoppers globally how they rate the places they shop and what drives their decisions about where to buy.

The last year has been a tough road for consumers and retailers alike, with economic uncertainty and high inflation squeezing consumer confidence and disposable incomes. Retailers have been faced with continued soft demand, price competition and inflating operating costs – which has driven laser focus on low prices and cost efficiency above all else.

We are now starting to see green shoots in consumer retail behaviour and growing optimism as inflation recedes in many markets. Improving trading over the coming 12 months could provide much-needed breathing space for retailers to re-assess priorities and ensure they are tackling long-term strategic issues.

In particular, we see four imperatives which should be on the agenda for retail leaders:

- Compete on Value, Win Through Trade Up: Invest behind competitive and attractive propositions beyond entry price points

- Don’t Forget the Fun: Inject excitement and enjoyment into retail experiences both online and offline to re-ignite customer engagement

- Navigate the Generation Game: Balance the divergent needs of different age groups through targeted product ranges and propositions catering to different lifestyles

- Accelerate with AI: Make targeted strategic bets on AI where it has the most meaningful potential to enable both operating models and customer propositions/experience

Tom Charlick

Partner, Head of Retail and Leisure

What we include in this report

-

01 This Year's Rankings

-

02 Compete on Value, Win Through Trade Up

-

03 Don't Forget the Fun

-

04 Navigate the Generation Game

-

05 Accelerate with AI

-

06 The Year Ahead

This year's rankings top of their category

Methodology

The OC&C Retail Proposition Index is a major piece of international consumer research measuring shopper attitudes and perceptions towards the world‘s leading retailers.

More than 48,000 consumers globally are asked to rate the retailers they have shopped on the strength of their overall proposition, and then to score the key elements of that proposition (Price, Range, Service, etc). These results are then used to compile a ranking of over 550 retailers from across the globe. Since the Retail Proposition Index was first launched in 2010, we have analysed over 67m ratings. Now in its 14th year, the index is a powerful tool to understand how shopper opinions and priorities have changed over time, and to identify the key long-run trends driving shifts in the retail landscape.

Compete on Value, Win Through Trade Up

Compete on Value, Win Through Trade Up

Anchor on competitive entry price points while investing in top-tier premium and sustainable ranges to drive trade-up

Entry price points will remain highly competitive over the next 12 months, with value-seeking behaviours entrenched in consumer memories and likely to persist. However, the importance of non-price factors is rebounding, with quality an important and growing consideration in how consumers assess value for money.

Price leadership alone is no longer enough to win in the long-term, and retailers must act to ensure they deliver value beyond headline price. Discounters remain highly popular, but few consumers (c.25%) report preference for them over other retailers and there is evidence of renewed focus on quality ranges by value players across categories (e.g. Aldi, Mango)

We are seeing green shoots of optimism in consumer sentiment across geographies

But value requirements are heavily entrenched and memory of the consumer squeeze persists

Matt Coode

Partner

The importance of quality is growing, and it is a core driver of consumer value perception

Price leadership alone will not be enough to win in the long-term, and retailers will need to re-establish other sources of differentiation

Aldi

Don't Forget the Fun

Don't Forget the Fun

Inject excitement and enjoyment into retail experiences both online and offline to re-ignite customer engagement

Fun has been lost from the retail experience, leaving retailers more exposed than ever to competition from leisure for consumer discretionary spending. Consumers continue to prioritise leisure spend over retail, and retailers lag digital leisure leaders (e.g. Airbnb, Just Eat) on Fun to Shop/Use ratings.

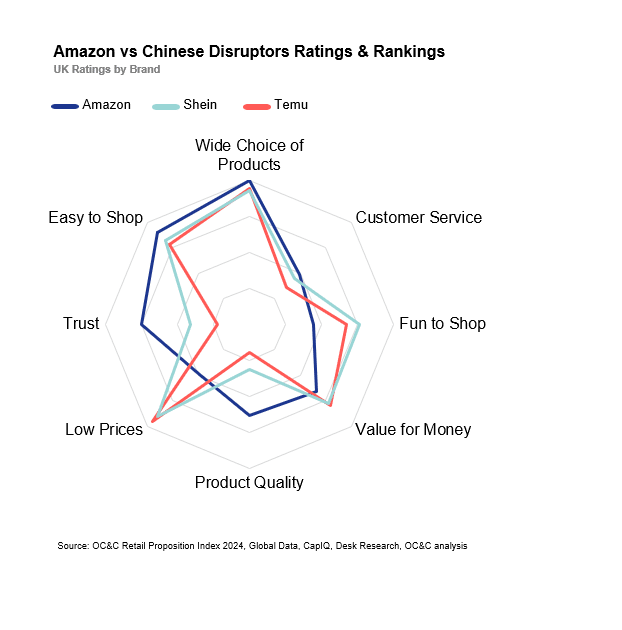

The new retail disruptors (Temu, Shein) should provide both inspiration and urgency in re-invigorating retail experiences, with their success anchored on both fun experience and low prices. This competitive threat is fundamentally different from the Amazon model (low price, breadth of range, easy to use) and will require a new response.

Example tactics for retailers include eclectic product ranges, gamification of the purchase journey and hyper-personalisation.

Consumers continue to prioritise experiences over shopping in their discretionary spending

Global leaders in digital leisure (e.g. Airbnb) have a set a new bar on fun user experiences, and are outperforming retailers

Luke Sparke-Rogstad

Associate Partner, Retail & Leisure

Shein and Temu are re-inventing fun retail experiences, and have a fundamentally different value proposition to Amazon

Navigate the Generation Game

Navigate the Generation Game

Balance the divergent needs of different age groups through targeted product ranges and propositions catering to different lifestyles

The youngest generations (Gen Z and Gen Alpha) now contribute a meaningful share of consumer spending (c. 25%), but this needs to be weighed carefully against an ageing overall population where Boomers and Gen X are the largest spenders (c50%).

Younger generations have increasingly polarised needs and priorities, which incumbent retailers are struggling to address. Gen Z ratings are materially lower, and few retailers are managing to resonate consistently across generations.

Retailers face an impending decision-point on whether they can credibly deliver ageless appeal, or whether they will need to pick a side of the generational divide. This will be crucial in developing future-fit propositions.

Gen Z and Alpha now contribute a meaningful share of consumer spend (25%+) – but this must be weighed against the 50% of GenX/Boomers

Today’s retail propositions are not resonating with younger generations, leading to them having worse perceptions of retailers overall

Retailers are faced with an impending choice on whether they can deliver ageless appeal – or to double down on a side of the generational divide

Accelerate with AI

Accelerate with AI

Make targeted strategic bets on AI where it has the most meaningful potential to enable both operating models and customer propositions/experience

AI will be a fundamental enabler in driving the next phase of transformation in retail operating models, accelerating both efficiency/quality improvements and strengthening the customer value proposition. Adoption is already growing with both retailers and consumers, but retailers need to be choiceful on both where and when to act to ensure the right investments are prioritised.

Given the dual focus on both operational efficiency and consumer propositions, AI is a strategic topic which should be on the agenda for CEOs and boards, rather than siloed with CTOs or operational teams. Critically, propositional investments in AI should have a clear customer lens and be targeted on strengthening areas of underlying strength/differentiation. For example, AI-enabled pricing will have most relevance for retailers with a strong price proposition.

This year’s Retail Proposition Index has surveyed attitudes of >48,000 consumers to establish adoption levels of AI propositions, and identify key pain points in the retail journey where AI could bring tangible value to customers.

Pain points for retail customers are well-known, and AI provides a new toolkit to address long-standing challenges in an efficient way

Consumer adoption in retail remains nascent, but there is already evidence of emerging use across global markets...

...with potential for rapid acceleration in retail as use cases are developed

The Year Ahead

What to Expect in 2025

Improving trading over the coming 12 months could provide much-needed breathing space for retailers to re-assess priorities and ensure they are tackling long-term strategic issues

As pressures ease, retail leaders should bring renewed focus to long-term customer strategy, and ensure that operational teams are developing future-fit value propositions for the target customers.

Areas of attention and targeted investment in the coming year could include:

- Improved variety and quality of trade up products/ranges within the assortment

- Enhanced online and offline store experiences which inject fun and excitement for shoppers

- Tailored propositions for diverging needs of different generations, with a clear view of which generations are the core target customer

- Selective trials of AI where it has most meaningful potential and is best aligned with the existing position

Contact our experts for our in-depth analysis

Contact Us

Tom Charlick

Partner

Matt Coode

Partner

Luke Sparke-Rogstad

Associate Partner