Embedded Finance – Opportunities for ERP and payroll SaaS providers

Embedded finance presents a significant opportunity for SaaS ERP and payroll providers. Our research indicates that businesses who invest in embedded finance solutions can expect a substantial EBITDA uplift of 20-30% over a 2–3 years period, with further long-term potential.

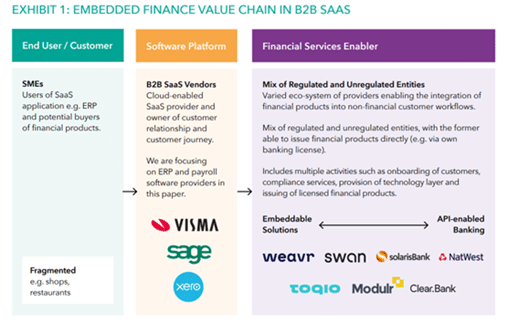

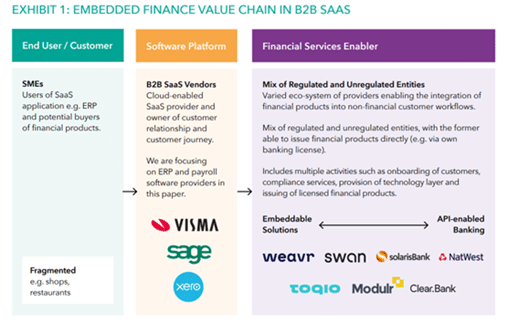

The Embedded Finance Value Chain

The embedded finance value chain typically involves three steps, from end customers (such as SMEs) to software platforms to financial services enablers as outlined in the diagram below.

New generation financial services enablers simplify the provision of financial products for SaaS providers by reducing the need for in-house fintech capabilities and the regulatory burden.

Emerging Embedded Finance Products

Financial products can be embedded throughout ERP workflows. Our report has identified multiple potential opportunities for embedded finance in ERP and payroll workflows including payment automation, company cards for expense tracking, and accessing business loans. Additional opportunities for payroll providers include earned wage access, payment of temporary and hourly workers and management of employees’ perks.

There are examples of SaaS businesses achieving material incremental revenue and profit through embedded financial products. For instance, Toast – a US provider of PoS software and systems for restaurants – generated c.80% of FY22 revenue and gross profit through finance technology solutions, including payments processing and business loans.

Estimating EBITDA uplift

Our research suggests a potential 20-30% EBITDA uplift for embedded finance propositions deployed at scale. This estimate could be considered conservative, since it does not account for incremental benefits such as increased customer retention from providing more mission-critical services.

‘Cost to play’ is estimated at c.30% of incremental revenue generated through embedded finance products. These include recurring fees paid to financial services enablers, cost of technical integration and additional customer support resources. These costs are mostly fixed or semi-fixed and therefore likely to benefit from scale, as the customer attachment rate increases.

Accessing the Embedded Finance Opportunity

SaaS providers can unlock the embedded finance opportunity via different approaches, including through partnerships with financial services enablers. This can facilitate rapid implementation, reducing the regulatory burden and eliminating any balance sheet risk. However, the embedded finance landscape is ever evolving, requiring a tailored strategic approach.

OC&C can help you navigate key strategic questions on this topic. We are passionate about the rapidly evolving world of B2B SaaS – having worked with many of the leading players in Europe. Please reach out to one of our experts or email [email protected] if you would like to discuss further.

主要联系人

James McGibney

Partner

Justin Walters

高层领导

Embedded finance presents a significant opportunity for SaaS ERP and payroll providers. Our research indicates that businesses who invest in embedded finance solutions can expect a substantial EBITDA uplift of 20-30% over a 2–3 years period, with further long-term potential.

The Embedded Finance Value Chain

The embedded finance value chain typically involves three steps, from end customers (such as SMEs) to software platforms to financial services enablers as outlined in the diagram below.

New generation financial services enablers simplify the provision of financial products for SaaS providers by reducing the need for in-house fintech capabilities and the regulatory burden.

Emerging Embedded Finance Products

Financial products can be embedded throughout ERP workflows. Our report has identified multiple potential opportunities for embedded finance in ERP and payroll workflows including payment automation, company cards for expense tracking, and accessing business loans. Additional opportunities for payroll providers include earned wage access, payment of temporary and hourly workers and management of employees’ perks.

There are examples of SaaS businesses achieving material incremental revenue and profit through embedded financial products. For instance, Toast – a US provider of PoS software and systems for restaurants – generated c.80% of FY22 revenue and gross profit through finance technology solutions, including payments processing and business loans.

Estimating EBITDA uplift

Our research suggests a potential 20-30% EBITDA uplift for embedded finance propositions deployed at scale. This estimate could be considered conservative, since it does not account for incremental benefits such as increased customer retention from providing more mission-critical services.

‘Cost to play’ is estimated at c.30% of incremental revenue generated through embedded finance products. These include recurring fees paid to financial services enablers, cost of technical integration and additional customer support resources. These costs are mostly fixed or semi-fixed and therefore likely to benefit from scale, as the customer attachment rate increases.

Accessing the Embedded Finance Opportunity

SaaS providers can unlock the embedded finance opportunity via different approaches, including through partnerships with financial services enablers. This can facilitate rapid implementation, reducing the regulatory burden and eliminating any balance sheet risk. However, the embedded finance landscape is ever evolving, requiring a tailored strategic approach.

OC&C can help you navigate key strategic questions on this topic. We are passionate about the rapidly evolving world of B2B SaaS – having worked with many of the leading players in Europe. Please reach out to one of our experts or email [email protected] if you would like to discuss further.

主要联系人

James McGibney

Partner

Justin Walters

高层领导