Investment Opportunities in Energy Transition

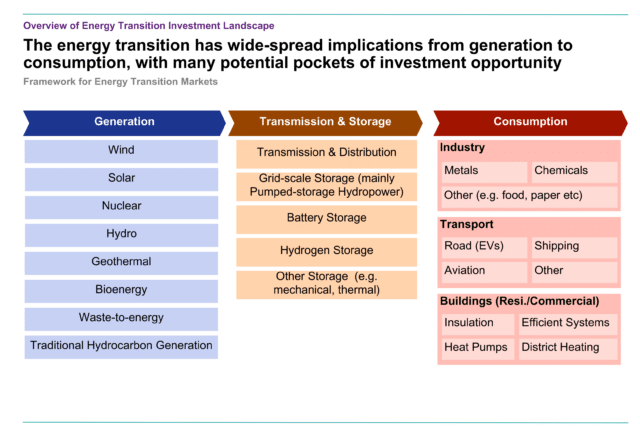

It is widely understood that the global energy transition creates many potential pockets of investment. We expect to see significant but varied growth in spend across geographies, parts of the value chain (from generation through to consumption) and end markets.

In the last 5 years, we have already seen significant increases in investment in energy transition, with an increase of >100% between 2019 and 2022 in deal volumes in the sector. European and US-based investors have typically targeted their investments on energy generation rather than transmission, storage or consumption over the last few years. This trend is a result of significant technological advances in recent years and increased policy tailwinds across European and US markets.

Key Considerations for Investment

While the energy transition market presents a sizeable value opportunity, investment should be made selectively. We’ve identified 5 key considerations to inform investor thinking:

1) Each geography behaves very differently

Individual geographies vary significantly in their net zero maturity and support for and availability of specific technologies. Therefore, the relative attractiveness of a specific asset type will vary significantly. It will be valuable to identify and invest behind leading geographic markets for a given technology, as there is often a significant first-mover advantage. Understanding both market and policy tailwinds will be critical to understand where the global winners will originate.

2) Policy is critical and can make or break returns on investment

Governments use a combination of financial incentives, target setting, and regulation to drive their net zero agendas, but always with one eye on politically popular (and unpopular) issues. Policy is a major determinant of market outlook in most Energy Transition markets. There are very few markets which take off in the absence of robust policy support, even where other geographic or economic factors are in their favour.

3) Target capacity and potential investment do not always translate to real market opportunity

Target capacity and spend certainty are different. Understanding the factors that can create a gap between theoretical and real market opportunity is vital. Investors must understand policy robustness, supply chain maturity, visible project pipeline, technological certainty and consumer engagement.

4) The effects will be wide-reaching and change who wins and how

Changes in energy transition will transform whole ecosystems, fundamentally altering the way consumers and businesses operate. New challenges will be created but there will also be increased opportunities for established business models to meet new needs in these markets. There are opportunities beyond just generation technologies which are often overlooked.

5) Current supply constraints can provide challenges but also opportunities

Supply chain constraints are a major factor influencing the pace of market expansion in some asset types, but can present an opportunity for business models that provide temporary or long-term relief to challenges in supply chains.

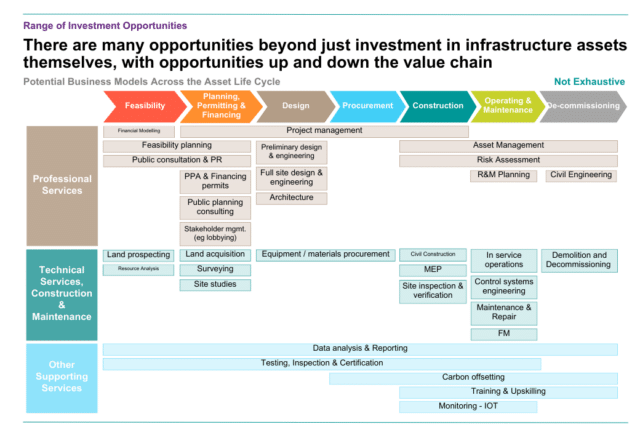

Range of Investment Opportunities

There are many opportunities for investors beyond infrastructure assets, with opportunities up and down the value chain – for example, in construction, procurement and design.

For our insights into the future of energy transition, see our latest report. If you would like to discuss any of the topics covered in this report, please contact: Chessy Whalen or Pontus Lofquist. For further information on our services, email [email protected].

主要联系人

Pontus Lofquist

Partner

Chessy Whalen

Associate Partner